TL;DR: In California, if you can’t make decisions, a court may appoint a guardian (conservator) to manage your affairs. This process is slow, costly, public, and puts control in someone else’s hands. A Power of Attorney (POA) lets you choose a trusted person to handle finances, property, or medical care—avoiding guardianship entirely. Durable POAs cover money and property, Medical POAs cover health decisions, and combining both offers full protection. At Bay Legal PC, we draft POAs tailored to your needs, ensuring they meet California’s legal requirements and help safeguard your independence, privacy, and wishes.

How a Power of Attorney Can Help You Avoid Guardianship in California

Imagine this: you’re in the hospital, unable to speak or make decisions. Your bills are piling up, your property needs attention, and doctors are waiting for someone to approve your treatment. But without the right legal documents in place, a judge—not you—will decide who gets that authority.

In California, that process is called guardianship (or conservatorship for adults). It’s costly, slow, and can put a stranger in charge of your life. The good news? A simple document—the power of attorney (POA)—can help you skip all of that.

At Bay Legal PC, we help Californians explore their options for creating a power of attorney (POA) tailored to their needs. Our attorneys explain how different POA types function under California law, outline the steps involved, and prepare documents designed to reflect your wishes while complying with state requirements. This guidance can make the process clearer and help reduce the risk of guardianship disputes in the future.

What Is Guardianship in California?

Guardianship is when a court decides you’re no longer able to handle your own affairs and appoints someone—called a guardian or conservator—to take over.

For adults, this could mean:

- A conservator of the person makes medical and personal decisions

- A conservator of the estate handles money, property, and business matters

While this might sound protective, the reality is far from ideal:

- It’s expensive: Court fees, lawyer fees, and ongoing costs can drain your assets

- It’s slow: It can take months before someone gets authority to act

- It’s public: Court proceedings make your private life part of the public record

- It’s uncertain: The court chooses the person—not you

Once a conservatorship starts, the court keeps supervising the guardian’s actions. They may need permission to sell your home, approve certain medical treatments, or handle investments.

How a Power of Attorney Helps You Avoid Guardianship in California

A California power of attorney is your way of saying, “If I can’t make decisions, I already know who I trust to step in.”

Instead of leaving the choice to a judge, you choose your agent—someone you know and trust—and give them the legal authority to act on your behalf.

Here’s how it works to avoid guardianship:

1. Immediate Authority When Needed.

A properly drafted power of attorney lets your chosen agent act immediately if you become unable to manage your affairs. This quick transfer of authority helps avoid the delays, costs, and emotional strain of guardianship proceedings. Instead of waiting for a court to appoint someone, your agent can step in right away to handle essential financial or medical decisions.

2. No Court Involvement.

A properly executed Power of Attorney (POA) eliminates the need for court-appointed guardianship by clearly naming who has authority to act on your behalf. This means there’s no lengthy legal process, no public court hearings, and no uncertainty over who will manage your affairs. Your chosen agent can step in immediately when you’re unable to make decisions, ensuring continuity and privacy in handling your financial or personal matters. By avoiding court involvement, you save time, reduce costs, and maintain more control over your future. A POA is a proactive step toward protecting your independence and decision-making power.

3. Keeps Control in Your Hands.

With a Power of Attorney, you stay in control of your life, even if you can’t act for yourself. You choose exactly what your agent can and cannot do—whether that’s handling your finances, paying bills, or making medical decisions. This means your wishes guide every action, not a court or someone you didn’t choose. By setting clear limits and instructions, you ensure your personal, financial, and healthcare matters are managed exactly how you want. It’s a practical way to protect your independence while still having a trusted person ready to step in when life takes an unexpected turn.

4. Protects Privacy.

A power of attorney safeguards your privacy by keeping your personal and financial matters out of the public eye. Unlike guardianship proceedings, which create public court records, a POA allows your chosen agent to manage your affairs discreetly. This means decisions about your health care, finances, and property remain confidential, shared only with those you authorize. By avoiding court involvement, you reduce the risk of unwanted attention or exposure of sensitive information. This private approach not only protects your dignity but also ensures that your personal life and important decisions stay between you and the people you trust most.

The Benefits of Power of Attorney in California

When it comes to how to avoid guardianship in California with a POA, the benefits are huge:

- Faster decision-making: No delays from court hearings

- Lower costs: Avoid expensive legal fees tied to guardianship

- More control: You choose your agent and outline their powers

- Peace of mind: Your loved ones know your wishes and can act on them immediately

Types of POA That Can Help You Avoid Guardianship

Different situations require different types of POA. To avoid guardianship, most people in California use one or more of these:

1. Durable Power of Attorney

A legal document that lets you choose someone you trust to handle your finances and property. Unlike other types of POA, it remains valid even if you become incapacitated, ensuring uninterrupted management of your affairs. With this authority, your agent can pay your mortgage, oversee investments, manage bank accounts, and handle taxes — all without the delays and costs of court involvement. It’s a powerful tool for keeping your financial life on track, avoiding guardianship, and ensuring your wishes are followed even during times when you can’t make decisions yourself.

- Purpose: Handles finances and property

- Advantage: Stays valid even if you become incapacitated

- Example: Your agent can pay your mortgage, manage investments, and handle taxes without court involvement

2. Medical Power of Attorney (Advance Health Care Directive)

A Medical Power of Attorney, also called an Advance Health Care Directive, lets you appoint someone to make health care decisions if you can’t. This trusted person can speak with your doctors, approve or refuse treatments, and ensure your medical care follows your wishes. It becomes crucial if you’re unconscious, seriously ill, or otherwise unable to communicate. For example, your agent can decide whether you should undergo surgery, start or stop certain medications, or choose life-support measures—helping you avoid court-appointed guardianship and ensuring that your health care choices remain in trusted hands.

- Purpose: Handles health care decisions

- Advantage: Lets someone you trust speak to doctors and approve treatments if you can’t

- Example: Your agent can decide whether you should have surgery or receive certain medications, based on your wishes

3. Combined Durable and Medical POA

A Combined Durable and Medical Power of Attorney offers complete protection by covering both financial and healthcare decisions. In California, this dual approach ensures there’s no gap in authority if you become incapacitated.

The Durable POA empowers your chosen agent to manage your finances, property, investments, and taxes, while the Medical POA—also known as an Advance Health Care Directive—authorizes them to speak with doctors, approve treatments, and follow your medical wishes. Together, they provide peace of mind, ensuring that trusted individuals can act quickly and effectively in your best interests without court delays or conflicts during critical moments.

Difference Between Durable and Medical POA in California

- Durable POA: Focuses on money and property; stays in effect during incapacity

- Medical POA: Focuses on health care decisions; only works when you can’t speak for yourself

Both can help avoid guardianship—but together, they provide full protection.

California POA Legal Requirements

To be valid under California POA legal requirements, your document must:

- Be signed while you’re of sound mind

- Be notarized or signed by two witnesses (special rules for medical POAs apply)

If your POA doesn’t meet these standards, it may not work when you need it most. That’s why working with an estate planning attorney is critical.

How to Choose the Right Power of Attorney in California

Choosing the wrong agent can be worse than not having a POA at all. Look for someone who is:

- 100% trustworthy

- Good with money and organized

- Able to communicate with doctors and professionals

- Willing to put your wishes above their own opinions

You can also name alternate agents in case your first choice can’t serve.

Steps to Create a POA That Avoids Guardianship

- Talk to an Estate Planning Attorney – Consult a qualified California estate planning attorney to select the right power of attorney type, ensuring full compliance with California’s specific legal requirements.

- Pick Your Agent – Choose a trustworthy agent who understands your wishes, responsibilities, and values. Discuss your preferences thoroughly to ensure they’ll act in your best interests.

- Sign the Document—Follow California’s required formalities, including notarization and appropriate witnesses, to ensure the power of attorney is valid, enforceable, and legally recognized statewide.

- Distribute Copies—Provide signed copies to your chosen agent, healthcare providers, and trusted individuals, and securely store an original for easy access during emergencies or important decisions.

- Review Regularly – Periodically revisit your power of attorney, updating it as your circumstances, relationships, or wishes evolve, ensuring it continues reflecting your current needs and intentions.

At Bay Legal PC, we prepare customized California power of attorney documents tailored to your goals and circumstances. We guide you through legal requirements and coordinate with your advisors when needed. Our aim is to reduce guardianship risks and give you peace of mind. Schedule a consultation and explore your options for safeguarding your future.

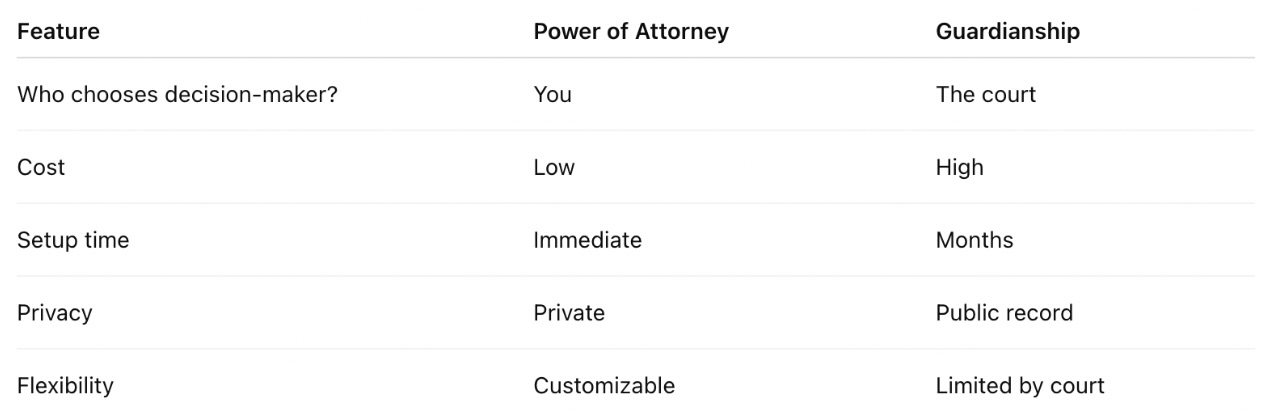

Quick Comparison: POA vs. Guardianship

A side-by-side guide showing how a Power of Attorney can help you avoid the costs and court process of guardianship in California.

Take Control Before It’s Too Late

Without a POA, a court may need to decide who will manage your health care, finances, and living arrangements if you become unable to do so.

A properly drafted California power of attorney can give you more control, help safeguard your privacy, and work to ensure your preferences are more likely to be followed—potentially avoiding costly and stressful guardianship proceedings.

If you would like to take the first step toward planning for the future, contact Bay Legal PC today at (650) 668-8000 or email info@baylegal.com to begin your personalized estate planning.